Providing 24x7 global protection

Financial crimes are becoming more complex by the day. While regulatory norms governed by technological advancement have helped banks and financial institutions safeguard against rising risk, an increase in dynamic workforces, AI-based digital intervention and tightening governance have forced service providers to create new operating models.

Our Financial Crime Prevention (FCP) practice —comprised of certified experts who leverage deep knowledge domain expertise and experience in the end-to-end processes they support —provides HCLTech customers with 24x7 global coverage and protection. Applying industry best practices to our efficient operational framework, we help financial institutions transform their operating models to improve business outputs and streamline internal processes while reducing cost outlays and mitigating the risk of financial crimes.

.webp)

Accelerating professional growth

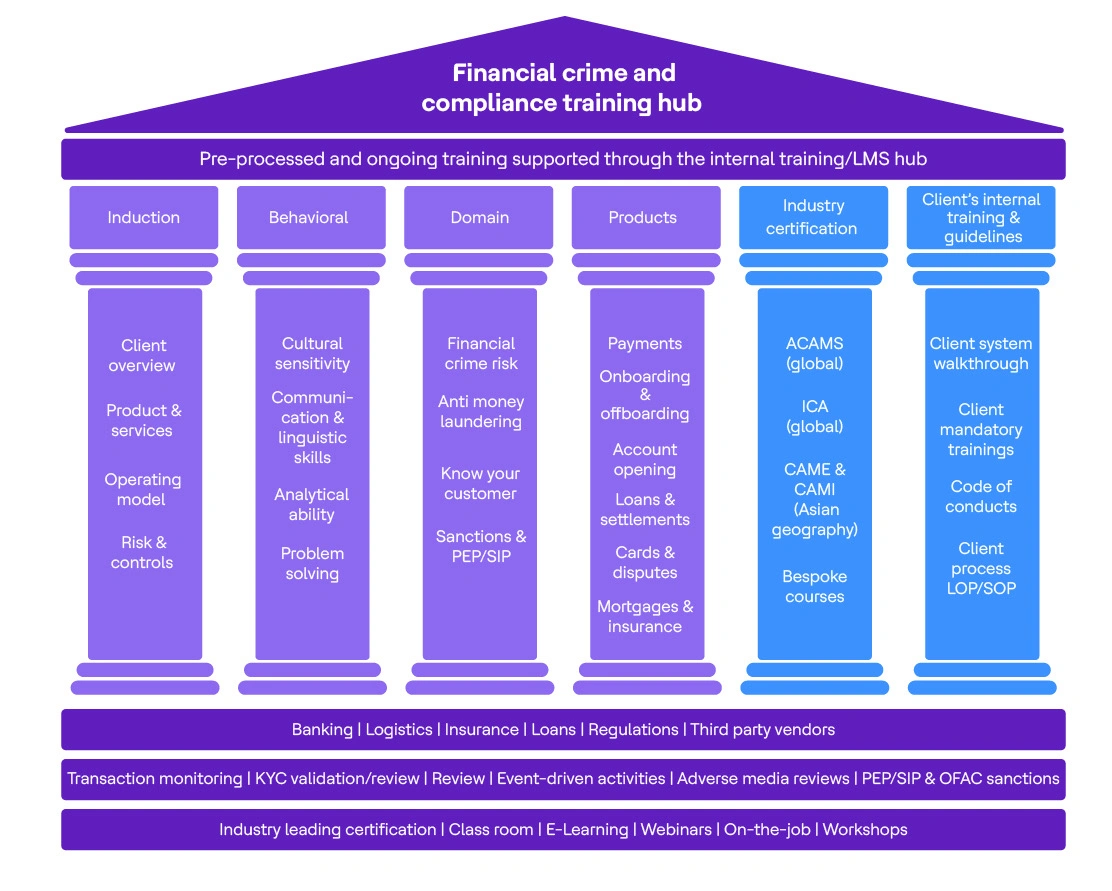

through Center of Excellence Academy

To arm our experts with the latest know-how on financial crime risks and create domain specialists, we have created our inhouse Center of Excellence Academy, one of the industry's deepest learning and training platforms.

Four levels of robust training are offered:

- Induction training for new joiners

- Specialist training for experienced candidates

- Advanced training for subject matter experts and managerial-level candidates

- Cross-training/Upskilling to ensure fungibility and flexibility

Value We Deliver

Cost efficiency

Compliance measures

Streamlined

operations

Expert

execution

Enterprise-wide KYC transformation for improved regulatory compliance

Learn how a leading European bank transformed their KYC platform to improve regulatory compliance.

Read the case studyOur Insights

Subscribe to the HCLTech Newsletter

for our latest news and insights